Purpose

In order for the Organization to achieve its mission it must understand the community it serves and the challenges and issues these stakeholders face.

In particular, the board can make a profound difference toward achieving the mission if it is selected, managed, and evaluated effectively.

This policy provides specific tools and resources for building an effective board. Specifically, it explores the roles and responsibilities of board members, focuses on the difference between governance and management, examines the importance of board selection and composition and provides models for orientation and training of board members. Finally, the policy addresses strategies for responding to board changes and assessing the effectiveness of both the board and the Organization.

For a board to function effectively and live up to its fiduciary responsibilities, it must govern at a high level focused on financial health, strategic issues, and important operational matters. A healthy board goes beyond “rubber stamp governance.” Likewise, a healthy board establishes independence, delegates work to staff, committees or volunteers and provides governance, objectivity, and accountability to the organization.

The purpose of this policy is to assist the board in fulfilling its fiduciary duties to grow a strong board that follows both legal requirements and nonprofit sector best practices.

Board Recruitment

The nature of a board is to turn over. The Organization’s bylaws enforce term limits on board members which require bringing in new members for board service.

The Organization’s Diversity Equity and Inclusion Policy requires the Organization to foster principles of diversity, equity, and inclusion in its mission-driven work, including in the election of its corporate directors.

Moreover, the Organization is prohibited by certain grant funding requirements from creating barriers to board service through the application process.

Yet board service is also an important and serious duty to the nonprofit corporation and board members take on critical legal and leadership responsibility when they become Directors.

Developing a board with a full complement of skills and abilities is important to good governance and preserving the health and wellbeing of the Organization.

Therefore, it is the policy of the Organization to observe the following practice with respect to board member recruitment. The board will:

-

- Promote member engagement in programs and committees or other volunteer opportunities with the Organization as a way to identify voting members who possess the qualities of a good board member. The qualities of a good board member include but are not limited to:

- Understanding of the community and its needs

- Passion for the cause

- Willingness to commit time for meetings, events, etc.

- Team player who works well in a group

- Ability to communicate directly even on difficult subjects

- Ability to participate in healthy conflict

- Shows respect for community members and other stakeholders

- Ability to put the best interest of the organization over personal interests

- Actively recruit new members to board service who are broadly representative of the community interests, including renters, business owners, and people from a variety of diverse perspectives.

- Publish calls for applications broadly following the Language Access Policy notice requirements to ensure that all eligible members are aware of opportunities to serve.

- Educate potential candidates about the requirements and responsibilities of board service before elections are held. This includes providing educational materials regarding:

-

-

- The three core fiduciary duties

- The Organization’s Conflicts of Interest Policy

- A reasonable estimate of the time commitment required to fulfill duties

- The Organization’s board member Code of Conduct agreement (see Exhibit A)

The Organization may publish this educational material on the Organization’s website or otherwise link to it in a board member application and will in all cases ensure that members who seek board service (even when nominated from the floor), have an opportunity to review these materials prior to accepting their nomination.

Using a Composition Matrix

The board may from time to time utilize a board composition matrix to detail the skills, characteristics and talents of the current board members and identify current gaps or future gaps that will arise with anticipated turnover.

The organization’s strategic direction can help to clarify the special skills and resources required on the board. For example, if increasing engagement with immigrant populations or finding sources of fee-for-service revenue are identified as strategic priorities in the next two years, then board may consider identifying eligible members whose skills and abilities could help advance these strategic goals.

Board Training

Board members have important fiduciary duties. They accept legal risk and responsibility for the nonprofit corporation. As a result, Directors must stay aware of changes in nonprofit corporate law, business law, nonprofit sector best practices and governance requirements.

Board education and training opportunities are intended to assist Directors with their responsibilities. This safeguards the Organization and ensures Directors can uphold their obligations, regardless of their previous education or experience.

Therefore, it is the policy of the Organization to provide both new and existing board members with training opportunities. These training opportunities may be combined when it is convenient. Board member trainings may be conducted internally and with the assistance of a qualified third-party provider that routinely provides training to Minnesota nonprofit boards.

New Member Orientation

New Directors will be oriented as quickly as reasonably possible, within 90 days of the meeting where the board member is elected. Board leadership will ensure that each newly appointed Director receives the following:

-

- Briefing from the Chair/President

- Briefing from the Executive Director (if any)

- New board member training

- Access to core documents (operations manual, policies, procedures, and access to past year of meeting minutes, etc.)

- Educational materials provided to all applicants as part of the application process and a signed board member agreement (See, Exhibit A)

Annual “Refresher” Training

Directors serving successive years of a term will participate in an annual board member training as a refresher course on their duties and obligations. This includes annual review and re-affirmation of the board agreement and the Conflicts of Interest Policy and disclosure form.

Training Content

At minimum, all board member orientations should cover the following topics:

-

- The Organization’s mission, vision, and values

- Bios of current board members and key staff

- Board member job descriptions and expectations

- Legal duties of board members in Minnesota (review of fiduciary duties, etc.)

- Review and sign the board member agreement

- Review the Conflicts of Interest Policy and complete the annual disclosure form

- Calendar of meetings for the year ahead

- Bylaws and Articles of Incorporation (their meaning and importance)

- Determination letter from the IRS and information about income-tax exemption

- State sales tax exemption (if applicable) and when it applies

- Summary of Directors’ and Officers’ insurance coverage

- Policies (or board resolutions) relating to the board’s role to review the CEO/executive director’s compensation

- Opportunity to review the operations manual with all core policies and procedures

Access to Information

All Directors must have access to the following documents in a board portal or other easy to use format:

-

- Current Bylaws

- Articles of incorporation (including amendments)

- Determination letter from the IRS

- Certificate of sales tax exemption from the state (if any)

- Summary of insurance coverages (including Directors and Officers, Work Comp, etc.)

- Policies (or board resolutions) relating to the board’s role to review the Executive Director’s performance and compensation

- Operations manual with all core policies and procedures

- Recent Organizational financial reports (balance sheet & income statement)

- Recently filed IRS Form 990s

- All past meeting minutes

- Calendar of meetings for the year ahead

- Board roster and list of committees, their charters, and who serves on them

Strategic Planning

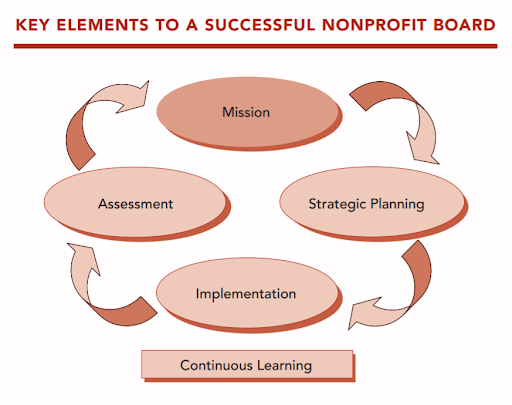

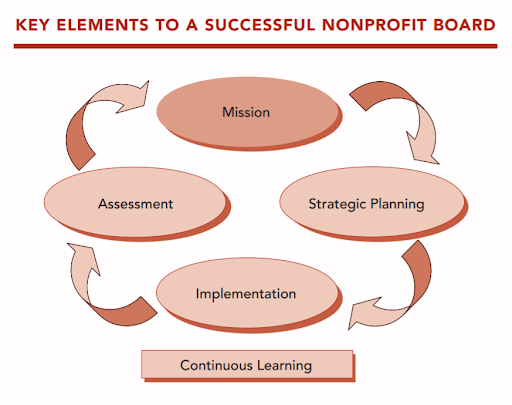

Board leadership is a continuous, multi-phase process that requires planning, oversight, and modifications based on assessment. First the board develops a mission and a strategic plan to meet that mission. Then the board provides oversight of the staff (i.e., employees, volunteers, or committee members) as they implement the strategic plan and report back to the board. Finally, during the assessment phase, the board critically assesses the success of the organization; its programs and services; as well as the board’s own performance, and the cycle continues.

The strategic plan is used to guide program activities, allocate resources, and assess the Organization’s achievements.

Specifically, the strategic plan provides the organization’s staff and leaders with guidelines to:

-

- Establish the Organization’s programmatic activities

- Allocate human and financial resources to accomplish those activities

- Assess whether objectives are being met

- Evaluate programs, staff, and resources

A strategic plan does not need to provide a detailed chronology of action (it isn’t an operational work plan). A strategic plan also cannot predict the future of the external world. Instead, the strategic plan broadly maps the goals or activities that the organization wants to pursue towards accomplishing its mission or to preserve (or change) its desired character and identity. As well as what resources it will allocate to that pursuit. The strategic plan is a tool that guides future decision-making as issues arise in the years to come.

Plan Structure

Generally, the strategic plan may follow this organizational structure:

-

- Vision / mission

- Core values

- SWOT analysis / situational assessment

- Organization-wide goals or objectives (3-4)

- Key performance indicators (quantifiable metrics – how do we measure success)

- Key objectives or milestones that support achieving the goals (i.e., quarterly objectives)

Policy & Guidelines

-

- Establish the Organization’s programmatic activitiesThe board will create a strategic plan that reflects and supports the Organization’s mission. The strategic plan and planning process will follow these guidelines:

- The planning process will engage or seek input from a broad cross-section of the Organization and its community of stakeholders

- The planning process will allow for enough time to gather data and map broad goals (this may be months rather than days or weeks)

- The planning process, although complimentary, will not be a substitute for budgeting

- The Organization may engage a third-party consultant for assistance with strategic plan development from time to time

- The plan developed will not exceed a three-year roadmap

- The plan developed should be easy to read and understand by the average person

Internal Assessment

The board is accountable for the Organization’s success (or failure). The board will annually measure the progress of the Organization against the goals laid out in the strategic plan. The board will also measure the performance of its Executive Director (if any) and its own performance in assisting and supporting the Organization in a consistent and positive way throughout the year.

The board should use the results of the annual assessment to make appropriate adjustments to the mission, planning, and implementation of operations.

Annual Effectiveness Assessments

To ensure accountability, the board will:

-

- Measure Organizational achievements against quantifiable objectives

- Perform a formal review of the Executive Director annually (if one is employed)

- Implement a member feedback mechanism to measure members’ responses

- Develop and implement a process of board self-assessment (individual and whole)

- Call in legal counsel or a management consultant for evaluation if difficulties come up

- Create processes for feedback for using assessments to improve the organization

Board Assessments

Board self-assessment provides members with an opportunity to:

-

- Reflect on their individual and corporate responsibilities

- Identify different perceptions and opinions among board members

- Point to questions that need attention

- Use the results as a springboard for board improvement

- Increase the level of board teamwork

- Clarify board / staff expectations

- Demonstrate that accountability is an organizational value

- Provide credibility with funders and other external audiences

Board members will evaluate their performance as a group and as individuals at least every two years.

The Organization may utilize assessments like those in Exhibit B and C, or use any third-party service, suitable online board assessment tool, etc.

The Organization will have clear procedures for removing board members who are unable to fulfill their fiduciary responsibilities

Approval & Adoption

Approved and adopted by a vote of the Board of Directors at a properly conducted meeting.

Secretary: Nikki Lindberg

Date: November 16, 2021

Revision History: n/a